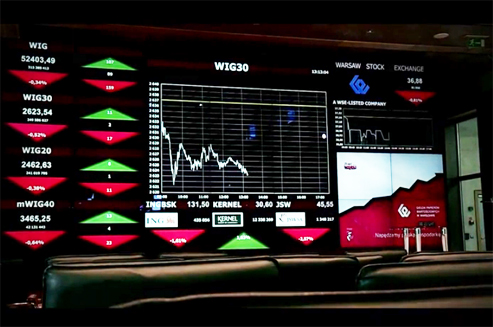

After the fall in the number of IPOs in the recent months, the Warsaw Stock Exchange has updated its 2020 strategy today. The bourse wants to base its growth on six pillars: a liquid equity market, a developed debt market, a competitive derivatives market, a commodity market attractive to investors, a comprehensive offer of information products for investors and issuers, and new business segments opened based on available competences.

“We believe that we can grow our business mainly by making our products and services more attractive and by tailoring them to genuine needs of our clients,” says the WSE’s President, Paweł Tamborski.

The Warsaw Stock Exchange looks to become strongly client-centric. The bourse will also strengthen its existing key business segments and grow based on the competences existing in the WSE Capital Group.

More information on: Why Emerging Europe

Photo © Why Emerging Europe